If you’re a woman entrepreneur, your time is now.

In Part 1 of

this two-part post, I talked to Andrea Guendelman and Fran Maier about

the challenges facing women entrepreneurs. Female tech entrepreneurs, in

particular, are few and far between, and they get funded far less often than

men. Part of the reason is that angel investors and venture capitalists are

predominantly male (85 per cent and 95 per cent, respectively) so they tend to

relate better to male than female entrepreneurs. There is clear evidence that a

subtle gender bias is at work in the VC industry.

That said, women entrepreneurs need to shoulder some of the

blame, too. They’re less inclined to be “dealmakers” and they tend to shy away

from math and computer science, the bedrock of countless tech startups.

Nevertheless, a 2012 Harvard Business Review report gives women entrepreneurs

plenty to cheer about. After interviewing over 7,000 business leaders, Jack

Zenger and Joseph Folkman, co-authors of A Study in Leadership: Women Do It Better Than Men (2011),

reported that women’s leadership skills are superior to men on many levels.

It’s definitely worth a read, but it also raised some important additional

questions in my mind:

- Do women “think big”?

- Where are the female VCs?

- How can women entrepreneurs get on a more even footing with men?

For answers to these questions I turned to three fast-rising

entrepreneurs: Sara Sutton Fell from

FlexJobs, Kelly Hoey from

Women Innovate Mobile and Meena Mansharamani from

GoGo squeeZ and Pup to Go.

Do women “think big”?

Does it matter? Yes it does. It can mean the difference between

getting funding for your startup or not. When funders are being pitched,

whether it’s on Shark Tank or Sand Hill Road, there’s one question they never

fail to ask: How big is your market? Behind this is the unstated question: Does

this person “think big”?

Serial entrepreneur Sara Sutton Fell remembers her personal

experience pitching VCs. Fell, who is CEO and founder of FlexJobs, a global

provider of telecommuting, freelance, part time and flex time job

opportunities, says that for venture capitalists “… it’s go big or go home. VCs

are simply not interested in a 10 per cent return over ten or twenty years.”

That just ties up their capital – capital they could use to buy into businesses

with high growth and highly profitable exit strategies. VCs invest to exit.

Fell bootstrapped her first company, JobDirect, by raising money

from friends and family, and then attracted funding from angel investors and

venture capitalists. But it took time. And vision. And big thinking. “We

weren’t playing small. We couldn’t. Not when you’ve spent $200,000 on three

relational databases and don’t have any revenue for eighteen months!” Women

entrepreneurs “tend to have smaller visions and goals than men, but investors

aren’t interested in financing a startup unless there’s a big return.” Fell

certainly had a big vision for a potentially huge market. This attracted

venture capital and an exit plan, and within a couple of years she and her

partners sold JobDirect to Korn/Ferry for 8 digits.

Where are the female role models?

Fell says that one reason women entrepreneurs don’t think big is

simply the lack of high profile female role models. Just as today’s male entrepreneurs

look to role models like Steve Jobs and Mark Zuckerberg for inspiration, women

entrepreneurs look to other entrepreneurial women. But unlike their male

counterparts, they often come up empty. Even the best and brightest need

inspiration. Google’s Sergey Brin admitted that “whenever Larry and I sought

inspiration for vision and leadership, we needed to look no farther than [Steve

Jobs].”

Where are the female rock stars? There’s no doubt that

Facebook’s Sheryl Sandberg and Yahoo’s Marissa Mayer are extremely influential

role models for women, and rightly so. But they do not technically qualify as

entrepreneurs, because they didn’t start a company or build one from the ground

up. As a result, their experiences and challenges are not always that relevant

to startup women. The closest high profile role model for women entrepreneurs

might be Oprah Winfrey, but her climb to success is an unusual one.

Corporate executive and entrepreneur Meena Mansharamani has a slightly different perspective.

She believes there are plenty of women role models. “What’s needed is more high

profile promotion of successful entrepreneurial women.” Mansharamani knows

whereof she speaks. She’s managing director of Materne North

America which owns GoGO squeeZ, a leader in squeezable 100% fruit pouches for

kids and families. She’s also the co-founder (with Cie Nicholson) of Pup To Go, a Manhattan

start-up that manufactures, markets and sells a high quality, high comfort dog

carrier that keeps dogs (and their super busy owners) happy. “Women need to be

showcased the same way men are,” she says.

Women-focused promotional conferences such as Startup Phenomenon Women, Women 2.0 and Astia help do that.

But based on my limited research, the business press could do a better job

covering these events. They could send more reporters to profile more of the

participants, and feature their stories more prominently, rather than tuck them

away in the “Life and Culture” sections.

Mansharamani thinks women need to be a little more assertive. Of

course, for women there’s a very fine line between being assertive and being

confrontational, and women have to be careful when walking that line because,

as Mansharamani notes, “assertiveness in women is not always as well received

as it is in men.” She advises women entrepreneurs to make good use of their

networks because networking is definitely a strength for women. Her own

entrepreneurial experience backs that up. When she started Pup To Go, she was

surprised at how big her own network was. She tapped it to find the designers

and tailors and marketers she needed to help her turn her concept into a business.

Where are the female VCs?

Who better to answer this question than Kelly Hoey, “one of five

women changing the world of VC/Entrepreneurship” according to Forbes. Hoey

is co-founder of Women Innovate Mobile, a startup accelerator focused on women

entrepreneurs. In her LinkedIn profile, Kelly refers to herself as a catalyst,

but non-stop global business networker might be an equally good description.

Hoey is well aware that she’s a rare bird in the VC world, because less than 10 per cent of high-level venture capitalists

are women.

Why so few female VCs? Hoey responds with a question: “Why are

there so few female investment bankers? Lack of role models. If women don’t see

role models in a particular sector, it becomes harder for them to see themselves

being successful there.” That’s a big reason why venture capital hasn’t been a

career path that women even considered. At least until now. “The rising tide of

female entrepreneurship has brought with it a new wave of female VCs,” says

Hoey. “This wave includes Katherine Barr at Mohr Davidow, Jeanne Sullivan at Starvest, Kathleen Utecht at

Comcast Ventures, Aileen Lee at Kleiner Perkins, Joy Marcus at

DFJ Gotham, and others.”

Hoey certainly believes in the power of women entrepreneurs.

That’s why she and her partners Deborah Jackson and Veronika Sonsev founded

Women Innovate Mobile. WIM is the first accelerator program to invest in mobile

startups with gender diverse founding teams, and provides women-owned mobile

tech companies with seed funding along with mentoring, resources and office

space. WIM’s investments include Appguppy, Loudly and SQL Vision. Hoey and her

partners understand how vital it is for women-owned startups to get early

“seed stage” funding (“concept” stage funding) so they can hire people and

generate revenues so they’re eligible for next stage (Series A) funding by institutional VCs.

When I asked Hoey who was most likely to become the next female

billionaire, she quickly mentioned Sophia Amoruso of Nasty Gal fame. Nasty Gal is a hugely

successful online fashion emporium. Seven years ago, Amoruso began selling

one-of-a-kind vintage clothing on eBay, and Nasty Gal was born. Today, the

company boasts revenues of $240 million, and sales growth is in the triple

digits.

How can women entrepreneurs get on a more even footing with men?

The data show that high growth companies – meaning scalable tech

companies, for the most part – are the biggest drivers of employment growth in

North America. Yet tech startups have traditionally been the preserve of young

men. The good news is, more and more women are entering tech fields, and

according to informal polls by Women 2.0, the number of women starting tech

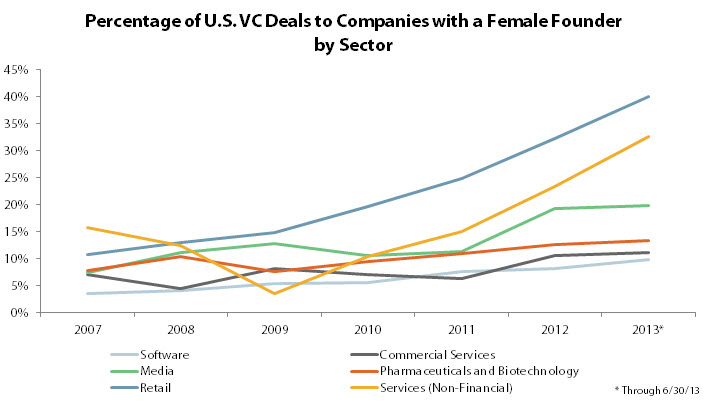

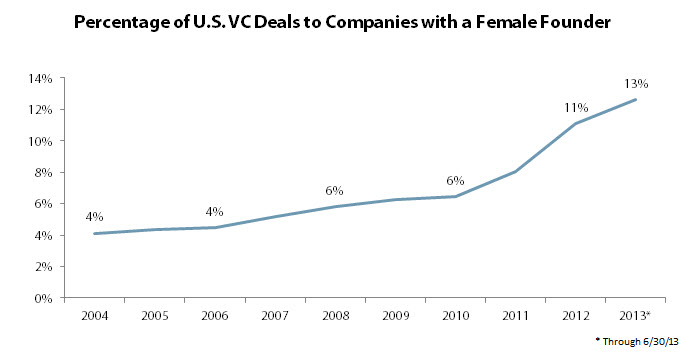

companies nationally has doubled in the past three years. Inc magazine’s Abigail Tracy notes that the number of venture capital

deals going to female founders is on the rise in 2013 according to the data

from PitchBook.

Over the course of these two blog posts (see part 1 here), we’ve covered a lot of ground and in the process

gathered a checklist of the strengths and weaknesses of women entrepreneurs.

What’s been missing so far is action. What can be done to inspire and create

more female startups? Here is a quick summary of the recommendations I received

from Andrea, Fran, Sara, Kelly and Meena:

- Build a company

that targets women and women’s products

- Take advantage

of social media networks which women already dominate

- Become more

assertive

- Become more deal

oriented

- Pitch female VCs

- Accelerate the

“cycle of inspiration” – more female entrepreneurial role models are

needed to inspire more women to become entrepreneurs

- Fund more

startups owned by women

- Learn to code.

Web-based tutorials such as Skill Crush help women learn to code, and there’s

even a comprehensive training program for women called, appropriately

enough, girls

who code

- Make an

entrepreneurship class mandatory for all business students

- Think big

- Tap into your

home-grown network and expand it

- Find a market

need and fill it

The bottom line: women

entrepreneurs are starting to come into their own. You might even argue that

there’s never been a better time to be a female entrepreneur because, as

awareness for the “female advantage” continues to grow in financing circles,

there will be an initial period where demand for women-run businesses with

exceed supply. Given that timing is everything in business, if you’re a woman

entrepreneur you might want to consider that your time is now.

- See more at:

http://www.feedthebeast.biz/blog/index.php/an-action-plan-for-women-entrepreneurs/#sthash.w9W1HFPD.dpuf