We know from personal experience that actions speak louder than words. But for entrepreneurs who want to grow their businesses in today’s market, the reverse may be true.

Let me explain.

When big business launches a new product or service, it’s news. It gets picked up by the media and broadcast by journalists free of charge. In other words, their actions are heard loud and clear.

No such luck for the little guys. When entrepreneurs launch new products or services or add an important new feature, their actions seldom create even a ripple in the marketplace. Entrepreneurs have to work ten times as hard to be heard, and generally even that is not enough.

So how do you get noticed? How do you get customers to listen when you tell the world you’ve got a better mousetrap? You can’t. Tell them, that is. They won’t even hear you for the noise.

So what’s the solution? First, you need to stop thinking like an entrepreneur for a moment. You need to stop thinking what you’ve always thought – that actions speak louder than words. That's what got you here. But now, to take your company to the next level, you need to start believing the opposite – that words speak louder than actions.

Why? Because in the digital age, the web is king. You wouldn't try and overpower a king or a queen, would you? It wouldn't work. You would always lose. Instead, you have to do what every wise figure has done since time immemorial -- you have to court him (or her) and become his trusted advisor and then potentially channel his (or her) power and influence.

It's somewhat like riding a giant wave. Anyone who learns to channel the power of the web will enjoy great success. Anyone who fights it will drown in a sea of noise.

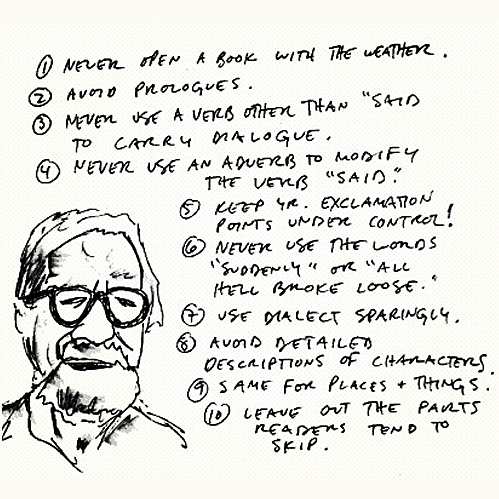

The key to the courtship is to stop shouting about what you want and start whispering about what your king (your customers) wants, and do it on a timely basis, in a relevant way, using simple to understand words based on insightful thinking. You mean blogging? Yes, I do. But with a difference. It's about quality, not quantity; relevance, not facts; emotion, not logic. This last point will be the subject of another post.

A venture capitalist named Rude VC has written an excellent post on this very subject, The importance of blogging for entrepreneurs. He says regular blogging is not about self-promotion. "It’s about communication of thoughts, transparency in opinions, and beta-testing ideas with the sounding-board of your readers.”

For emphasis, he links to another blog and a post by a VC named Charlie O’Donnell. The post is entitled, Why Every Entrepreneur Needs To Blog. It’s well worth the read, especially for priceless nuggets such as this one:

“If you aren't journaling what you're seeing and doing in a thoughtful way, you're running your company based on year or more old information, never cleaning off your blind spots.”

The key to creating compellingly readable posts and articles that show up in search engine results is to be thoughtful and responsive and authentic and emotive. Every entrepreneur wants to speak persuasively to hundreds, even thousands, of high quality prospects. The web let's you do that without having to place expensive ads in magazines and newspapers and television. The catch? Be prepared to spend less time promoting and more time emoting.

More on this later.